The Estate Planning Attorney Ideas

The Estate Planning Attorney Ideas

Blog Article

Estate Planning Attorney - Questions

Table of ContentsThe smart Trick of Estate Planning Attorney That Nobody is DiscussingEstate Planning Attorney - QuestionsFascination About Estate Planning AttorneyThe Facts About Estate Planning Attorney Uncovered

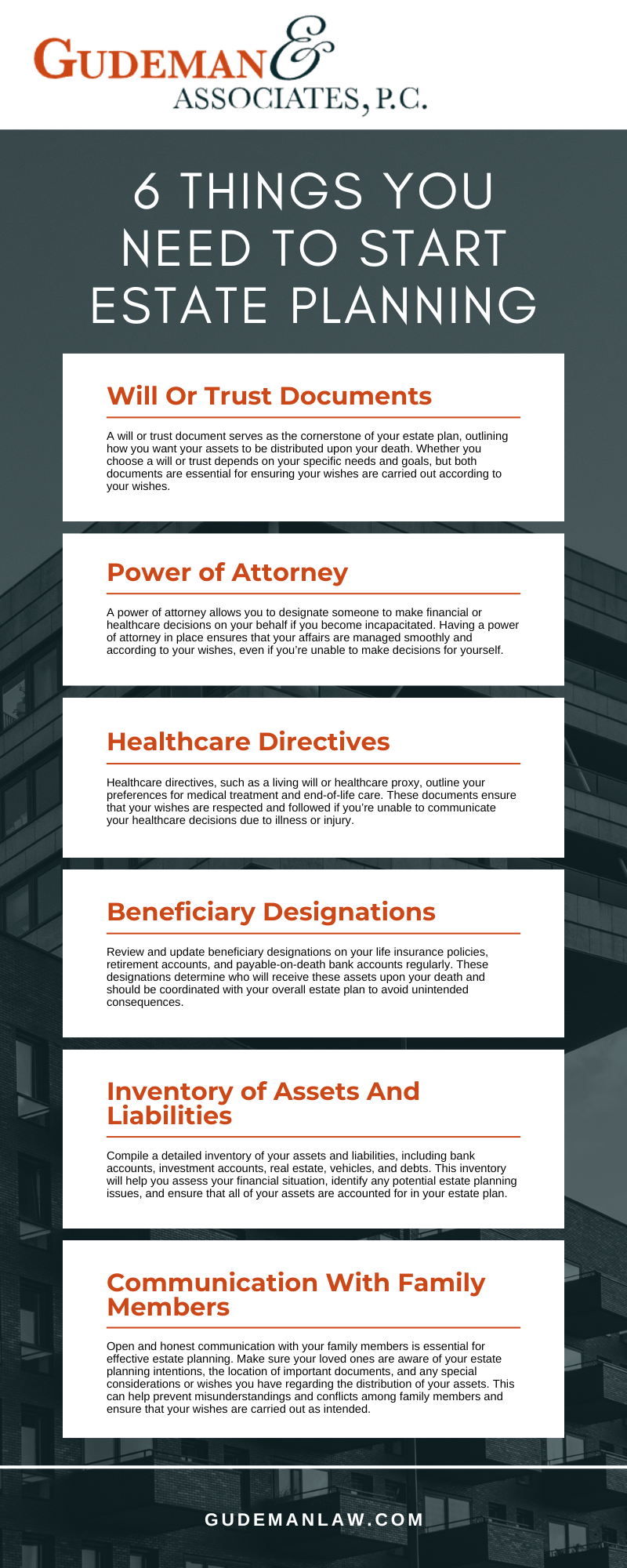

Estate preparation is an action strategy you can utilize to identify what occurs to your properties and responsibilities while you live and after you die. A will, on the various other hand, is a legal paper that lays out how properties are distributed, who looks after youngsters and animals, and any type of other desires after you die.

Insurance claims that are denied by the executor can be taken to court where a probate court will certainly have the last say as to whether or not the claim is valid.

Things about Estate Planning Attorney

After the inventory of the estate has actually been taken, the worth of properties calculated, and tax obligations and financial debt paid off, the executor will certainly after that seek authorization from the court to distribute whatever is left of the estate to the recipients. Any estate tax obligations that are pending will come due within nine months of the day of death.

Each private areas their possessions in the depend on and names somebody various other than their partner as the recipient. A-B counts on have become less popular as the estate tax exemption functions well for the majority of estates. Grandparents might move possessions to an entity, such as a 529 plan, to support grandchildrens' education.

10 Simple Techniques For Estate Planning Attorney

Estate planners can collaborate with the contributor in order to minimize gross income as a result of those payments or develop strategies that make best use of the impact of those contributions. This is another approach that can be used to restrict death tax obligations. It involves a private securing the existing worth, and therefore tax obligation obligation, of their home, while connecting the worth of future growth of that resources to one more individual. This method includes cold the value of a property at its value on the day of transfer. As necessary, the amount of prospective resources gain at death is likewise iced up, enabling the estate coordinator to approximate their potential tax responsibility upon death and better prepare for the payment of earnings tax obligations.

If sufficient insurance coverage profits are available and the policies are properly structured, any type of revenue tax obligation on the deemed dispositions of possessions complying with the death of a person can be paid without considering the sale of assets. Proceeds from life insurance coverage that are obtained by the recipients upon the fatality of the guaranteed are usually income tax-free.

Other fees related to estate preparation consist of the prep work of a will, which can be as reduced as a few hundred dollars if you use one of the best online will makers. There are certain files you'll require as component of the estate preparation procedure - Estate Planning Attorney. Several of one of the most typical ones consist of wills, powers of attorney (POAs), guardianship designations, and living wills.

There is a myth that estate preparation is only for high-net-worth people. Estate intending makes it blog much easier for individuals to establish their dreams before and after they die.

The Ultimate Guide To Estate Planning Attorney

You need to begin preparing for your estate as quickly as you have any measurable property base. It's a continuous procedure: as life progresses, your estate strategy ought to change to match your scenarios, in line with your new goals. And maintain at it. Refraining your estate planning can create undue monetary burdens to liked ones.

Estate planning is frequently believed of as a More Info tool for the well-off. Estate preparation is additionally a fantastic means for you to lay out plans for the treatment of your minor children and animals and to web link describe your desires for your funeral service and preferred charities.

Qualified applicants who pass the examination will certainly be formally certified in August. If you're eligible to rest for the test from a previous application, you may submit the brief application.

Report this page